Do you know what is EPS Scheme Certificate of your EPF Account? Many

employees unaware of EPS and EPS Scheme Certificate. Let us discuss more

about this in this post.

Before

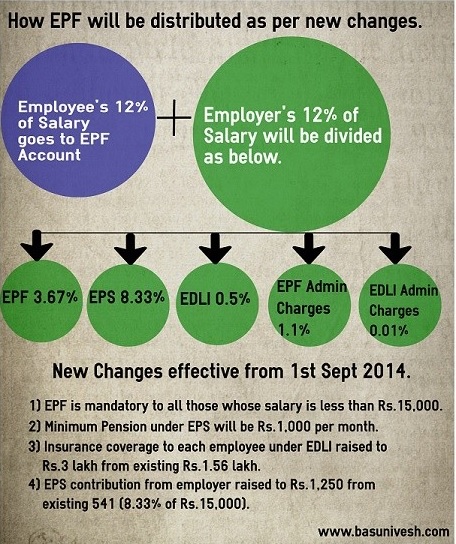

proceeding further, first, let us understand how your EPF contribution

is divided. I have written a detailed post in this regard earlier (Employee Provident Fund (EPF)-Changed rules from 1st Sept 2014“. However, I will again show you in detail about your and your employer EPF contribution is split.

You

notice that employee is not at all contributing to EPS. However, an

employer contribution of 8.33% from 12% is going towards the EPS. Few

points related to EPS are as below.

You

notice that employee is not at all contributing to EPS. However, an

employer contribution of 8.33% from 12% is going towards the EPS. Few

points related to EPS are as below.

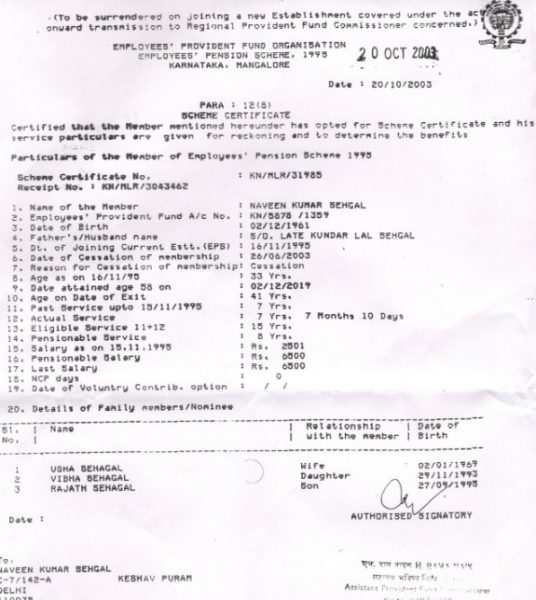

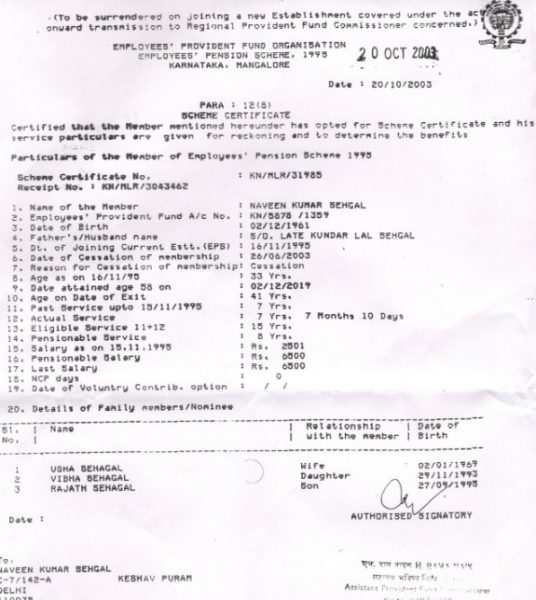

Below is an example of one such EPS Scheme Certificate.

However, if your service period is 9 years and 6 months, then your service is considered as 10 years for consideration.

Suppose you are joining a new company, then you can surrender the scheme certificate through the new employer and by doing so your past service will be added to the new service and your pensionable service would be cumulated.

Let me give you a detailed possibility of an employee applying for EPS Scheme Certificate.

Your employer sends the same to EPFO and then EPFO will issue you an EPS Scheme Certificate. If your all inputs are correct, then EPFO will issue you the EPS Scheme Certificate within a month or so.

However, if your length of service is more than 10 years, then you have to apply for EPS Scheme Certificate through your past employer.

When you join the new company, then you have to fill the Form 11 (which is also called a new joinee form of EPF). This is a self-declaration by an employee about the status of his EPF details.

While submitting this form you have to submit the EPS Scheme Certificate to EPFO through your new employer.

When you leave the job, you will again have to fill Form 10C. The EPFO will add the new number of years in the scheme certificate showing the cumulative service record and give it back to you through your employer.

You have to do this till you reach the age of 58 and then surrenders the certificate to the EPFO to start getting the pension. Or One may opt for an early pension (reduced to the extent) after 50 years provided one has completed 10 years of service.

Do remember that to be eligible for the pension (for a lifetime and then family pension), one has to work for a minimum of 10 years. Also, your pension will start at the age of 58 years of your age.

The pension that you will receive is capped and is based on the following formula:

The employee has to include all his past services to arrive at such 10 yrs of service and apply for the pension once he attains the age of 58/50. He needs to fill the Form 10D and get attested by that bank manager with photo and other required documents. Submit the form to concerned EPFO.

You no need to worry. Because this is what the EPFO response in this regard.

‘When PF is transferred from one organization to another, service details information such as non-contributory period, service length, wage last drawn etc. are sent over using Annexure K to the receiving PF office. These details are used for EPS calculation and hence, the total amount accrued in the pension fund is not mentioned in the UAN passbook.’

Hope this much information is enough for you all to know about EPS Scheme Certificate.

- An employee will not contribute to EPS. However, employer’s 8.33% contribution is going towards EPS.

- EPS will not earn a single rupee of interest!! Yes, you heard it right. Your EPF will earn the interest as per the yearly declaration by Government. However, EPS is IDLE amount without adding a single rupee to it.

- Whether EPF is managed by EPFO or your employer (a Trust), EPS is always managed by EPFO.

- If you have worked for less than 6 months, then you are not eligible for EPS withdrawal. Because as per the EPFO rule, those who have not yet completed 180 days in the organization, the withdrawal benefit is not admissible. One can, however, apply for the scheme certificate.

- However, when you switch the job, then you have an option either to withdraw the EPS amount or carry forward with your new job. Remember that this EPS withdrawal again depends on the length of the service.

- If you have not completed the 10 years of service, then you have an option to either withdraw EPS or apply for scheme certificate.

- However, if you have completed 10 years of service, then you are not allowed to withdraw the EPS. You have to apply for EPS Scheme Certificate.

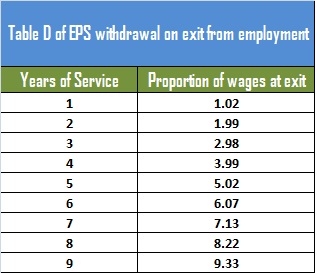

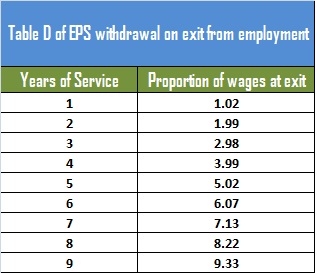

- If you are withdrawing the EPS before the completion of 10 years, then you will not receive the full EPS contribution. The EPS withdrawal, in this case, depends on Table D of EPS. It is some % of your EPS balance based on the length of your service. Assume your salary at the time of EPS withdrawal after 9 years, by filing form 10C, is Rs 15,000, then the EPS money one receives is Rs 1,39,950,300 (Rs 15,000 * 9.33). Refer below image for the same.

- Pension begins at the age of 58 years. To avail the pension, one needs to fill Form 10D through the last Employer.

- EPS contribution cannot exceed Rs.1,250 in any given month. Because it is capped at 8.3% of Rs.15,000 (A maximum salary ). Here salary means only Basic+DA.

- Do remember that if you are contributing to EPF, then you are also the member of EPS.

What is EPS Scheme Certificate?

EPS Scheme certificate is a certificate issued by EPFO. It provides the details of service of the EPF member (an employee). The EPS Scheme Certificate shows the service and family details of an employee member who are eligible to get EPF pension in case of death of the member. EPS Scheme Certificate is also an authentic record of service. Because it shows the history of your employment.Below is an example of one such EPS Scheme Certificate.

How the length of the service is considered of an employee to issue EPS Scheme Certificate?

Your length of the service is rounded off if the months are more than 6 months. Assume that you have completed 5 years and 4 months, then the service period is considered as 5 years only.However, if your service period is 9 years and 6 months, then your service is considered as 10 years for consideration.

When can an employee apply for EPS Scheme Certificate?

As I explained above, if you have completed less than 10 years of service, then you are eligible either to withdraw the EPS or apply for EPS Scheme Certificate. However, if you have completed more than 10 years of service, then you have to apply for EPS Scheme Certificate and you are not allowed to withdraw the EPS.Suppose you are joining a new company, then you can surrender the scheme certificate through the new employer and by doing so your past service will be added to the new service and your pensionable service would be cumulated.

Let me give you a detailed possibility of an employee applying for EPS Scheme Certificate.

# If your age is less than 50 years of age and you have not completed the 10 years of service

In such situation, you have an option either to withdraw the EPS (as per Table D) or apply for Scheme Certificate by using the Form 10C.# If your age is less than 50 years of age and you have completed the 10 years of service

In such situation, you have no other option but to apply for EPS Scheme Certificate using the Form 10C.# If your age is more than 50 years but less than 58 years of age and you have not completed the 10 years of service

In such situation, you have an option either to withdraw the EPS (as per Table D) or apply for Scheme Certificate by using the Form 10C.# If your age is more than 50 years but less than 58 years of age and you have completed more than the 10 years of service

In such situation, you have no other option but to either apply for EPS Scheme Certificate using the Form 10C or for reduced pension using Form 10D.# If your age is more than 58 years of age but your service is less than 10 years

You can withdraw the EPS using the Form 10C.# If your age is more than 58 years of age and your service is more than 10 years

You have to apply for pension using Form 10D.How to apply for EPS Scheme Certificate?

Once you are leaving the job, then you have to fill the Form 10C. Here, there are options either to withdraw EPS or apply for EPS Scheme Certificate.Your employer sends the same to EPFO and then EPFO will issue you an EPS Scheme Certificate. If your all inputs are correct, then EPFO will issue you the EPS Scheme Certificate within a month or so.

EPS Scheme Certificate when you join the new company

When you join the new company, then if your length of service is less than 10 years, then you can opt for EPS Scheme Certificate or can withdraw.However, if your length of service is more than 10 years, then you have to apply for EPS Scheme Certificate through your past employer.

When you join the new company, then you have to fill the Form 11 (which is also called a new joinee form of EPF). This is a self-declaration by an employee about the status of his EPF details.

While submitting this form you have to submit the EPS Scheme Certificate to EPFO through your new employer.

When you leave the job, you will again have to fill Form 10C. The EPFO will add the new number of years in the scheme certificate showing the cumulative service record and give it back to you through your employer.

You have to do this till you reach the age of 58 and then surrenders the certificate to the EPFO to start getting the pension. Or One may opt for an early pension (reduced to the extent) after 50 years provided one has completed 10 years of service.

How much pension can one receive under EPS?

As I already explained in above post, the maximum contribution to EPS by the employer is capped at Rs.1,250 or 8.33% of your actual salary (whichever is less).Do remember that to be eligible for the pension (for a lifetime and then family pension), one has to work for a minimum of 10 years. Also, your pension will start at the age of 58 years of your age.

The pension that you will receive is capped and is based on the following formula:

(Pensionable Salary * service period) / 70

The

pensionable salary is capped at Rs 15,000 and service period at 35

years. Hence, irrespective of the actual years and the basic salary,

the maximum monthly pension would be Rs 7,500.How to apply for EPS Pension?

Once you complete the service of 10 years, then you get the scheme certificate. This scheme certificate can be used to claim your pension either from 58/50 Yrs.The employee has to include all his past services to arrive at such 10 yrs of service and apply for the pension once he attains the age of 58/50. He needs to fill the Form 10D and get attested by that bank manager with photo and other required documents. Submit the form to concerned EPFO.

What happens to EPS when you switch the job?

When you switch the job, then you apply for EPF transfer request. But to the surprise, EPF is transferred but EPS field showing ZERO right?You no need to worry. Because this is what the EPFO response in this regard.

‘When PF is transferred from one organization to another, service details information such as non-contributory period, service length, wage last drawn etc. are sent over using Annexure K to the receiving PF office. These details are used for EPS calculation and hence, the total amount accrued in the pension fund is not mentioned in the UAN passbook.’